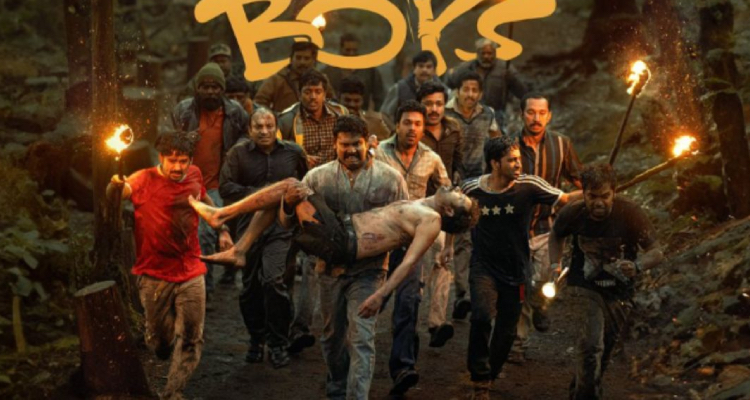

Manjummel Boys OTT: Where & When to Watch?

The latest surprise hit movie Manjummel Boys is receiving praise all over. Get Where & When to Watch on OTT?

New OTT Releases this Week, Upcoming Movies, Web Series on Netflix, Prime, Hotstar & ZEE5

Check here for a New OTT releases this week, New Movies in OTT This Week 2024. Upcoming Movies, web series & Shows on Netflix, Amazon Prime & HotStar.

Meet Larrisa Bonesi: 7 Sizzling Photos of Aryan Khan’s Rumored Girlfriend

Is Aryan Khan Dating Brazilian actress Larissa Bonesi? 7 Sizzling Photos of Aaryan Khan's Rumored Girlfriend.

The Kerala Story TV Premiere Date Today: Where & When to Watch?

2023's one of the most successful film The Kerala Story is all set for TV Premiere after one year of theatre release. Get The Kerala Story TV Premiere Date Today: Where & When to Watch?

Latest Entertainment

Vijender Singh, Gourav Vallabh and other Popular faces Who Quit Congress ahead Loksabha Elections 2024

The Lok Sabha elections, also known as the General Elections, are the largest democratic exercises in India, determining the composition of the Lok Sabha, the lower house of Parliament. These…

SSC CHSL 2024 Notification, Exam Date, Online Form & More

SSC CHSL 2024: The Staff Selection Commission is all set to release the SSC CHSL 2024 notification in April 2024, on their official website at ssc.gov.in. The SSC conducts the…

SSC GD Constable 2024 Exam Date, Result, Exam Pattern, Syllabus & More

SSC GD Constable 2024: The Staff Selection Commission released the SSC GD Notification on November 24, 2023, for 26146 vacancies. The exam is held to recruit candidates for the post of…

SBI Clerk 2024 Notification, Exam Date, Eligibility, Selection, Syllabus & More

SBI Clerk 2024 Notification: The State Bank of India conducts the SBI Clerk exam annually to recruit candidates for the Junior Associate/Clerk post in various SBI branches. The SBI Clerk…